Uncertainty Comes at a Cost

- Sales in February down 11% year-over-year

- New listings in February drop 9% from January

- Active listings continue to accumulate at a slower rate

- Tariff troubles begin

The year of political uncertainty continues. Tariff or not to tariff has been the question to start 2025 and continued through the month of February before culminating with a thud of tariffs on March 3. And while the hush that came across from buyers wasn’t all too unexpected, some sellers as well joined in the pause of activity in February.

While sales in February were above the totals in January, new listing totals declined in February from January, not a common occurrence in the real estate market. It appears that the uncertainty around tariffs and interest rates affected the real estate market in February. This uncertainty may play out in the coming months, not to mention Canada’s own federal election coming this year. And the election promises are likely to impact what decisions people make with real estate. There is already talk of GST exemptions on new homes either up to $1M or $1.5M depending on which candidate wins, capital gains discussions and likely a push for supply from all sides. With 1.2 million mortgages up for renewal in 2025, some homeowners that have been afraid to make a move due to locked in low rates may now look to make that move they weren’t prepared to do as opposed to just renewing their mortgage.

Amidst all the political talk, the Bank of Canada will make their next interest rate decision on March 12th, with expectations somewhat mixed on whether another rate cut will happen. With tariffs now in place, the Bank of Canada may need to do another jumbo cut of at least 50 points. With inflation still below 2% and Canadian GDP sputtering along, the case is there for another rate cut by the Bank of Canada. And that’s even before considering the effects of tariffs. And when the economy suffers due to tariffs, expect the same to be considered when the Bank of Canada meets in April again.

There were 1,827 properties sold in Greater Vancouver in February after 1,552 properties sold in January, 1,765 properties sold in December, and 2,181 properties sold in November. The real estate market has undertones of a market wanting to move – literally. The increase in sales from January came amidst much political uncertainty and with fewer listings coming on the market in February compared to January. Cautiously moving forward, with buyers still having the advantage in today’s real estate market.

Greater Vancouver home sales lagged the previous year for the first time since September after a strong fourth quarter in 2024. No one should be surprised. Sales in February were down 11% compared to February 2024 with 2,070 homes sold and the same as February 2023 at 1,824 sales. This after January was 9% higher compared to the 1,427 properties sold in January 2024 and were a 51% increase from the 1,030 sales in January 2023. Heading east, the Fraser Valley region saw sales in February down 27% compared to February 2024 and at similar levels to February 2023.

Greater Vancouver sales in February were 39% below the 10-year average compared to January where sales were 29% below the 10-year average, December which was 12% below the 10-year average and November sales at 13% below the 10-year average. This was not a typical February, due mostly to uncertainty and partly due to weather with a 2-week cold snap which included snow (although nothing in comparison to the snow experienced in Eastern Canada.) Only fives times since the year 2000 have we seen less than 2,000 sales in Greater Vancouver for the month of February. Considering there were 4,051 sales in February 1989, this goes to show how few transactions are occurring given the increase in population and housing stocking over the last 35 years. People are holding on to the homes they buy, which exacerbates the lack of supply of available homes. And with a project in North Vancouver’s Lynn Canyon switching to all rental as opposed to a mix of rental and strata, there will be 205 fewer units available to purchase in that already supply starved market. At least Port Moody got the memo for more supply as they approved the first towers for its downtown core with over 1,000 units approved in 3 towers near the Moody Centre Sky Train station.

Sellers were less active in February, perhaps joining buyers on the side of uncertainty. There were 5,163 new listings in February, compared with 5,644 new listings that came on in February in Greater Vancouver. With sales levels still lagging through the first two months of the year, this might have kept some sellers taking a wait and see approach. But it was still well above the numbers of new listings compared to February last year which saw 4,651 come on and significantly more than the 3,559 new listings that came on the market in February 2023. The sales to listings ratio did rise in February, with 35% of new listings selling during the month, compared to 27% in January. But still below the 45% in February 2024 and 51% in February 2023. This points to more favourable conditions for buyers as well.

The number of new listings in February were 12% above the 10-year average, compared with January which saw the number of new listings 30% above the 10-year average and December was right at the 10-year average. There were properties listed in January that came off the market in late 2024 which added to the totals for that month and after seeing the slower start to the year and continued uncertainty, some sellers may have decided to wait and see if there are any impacts from the tariffs and resulting economic damage. March typically produces more new listings as the spring market kicks in. Even with the two-week school spring break, we’ll likely see more listings again this year compared to February but that could also depend on what the economic climate is like as we move through these tumultuous times. Predicting the future is subject to many variables so typical may not be part of the vocabulary for March this year.

There were 12,744 active listings in Greater Vancouver at month end, compared to 11,494 at the end of February. About 250 listings came off the market after the end of February, so March started with a lower total of active listings.

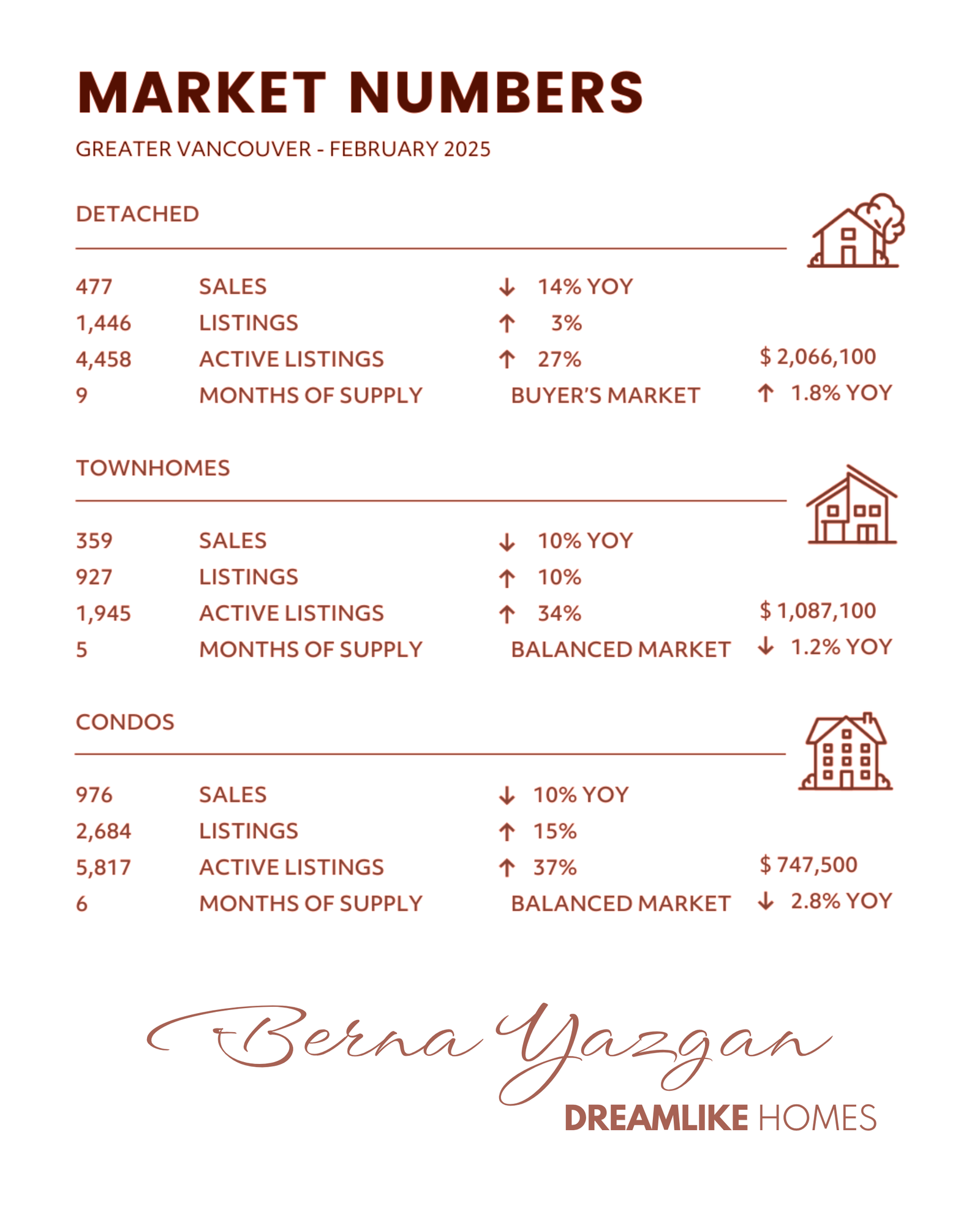

Months of supply remained at 7 months in Greater Vancouver due to less listings coming on in February. The detached market in Greater Vancouver dropped down to 9 from 11 months supply, compared to 8 months supply in December while townhomes stayed at 5 months after being at 4 months in December and condos also held, staying at 6 months after being at 5 months in December. The trend of townhome properties being the least available and most competitive continued. North Vancouver and Port Coquitlam remain in a seller’s market with only 4 months of supply with Burnaby North and Ladner dropping down to 4 months supply in the townhouse segment and Port Moody, Port Coquitlam, Pitt Meadows and Maple Ridge sitting with 2 months supply. Squamish saw a significant jump in sales in February and now sits with 2 months supply of townhouses while detached is at 3 months supply in Squamish.

Townhome sales in January for the region were up 10% compared to February last year, while condos sales were up 15% year-over-year. Detached sales lagged those product segments at 3% up from February last year. Townhome inventory overall was up 34% year-over year compared to 39% at the end of January, while condo inventory remained up 37% and detached homes were up 27% compared to 28% year-over-year at the end of January.

The Greater Vancouver real estate market in February 2025 reflected ongoing political and economic uncertainty, with tariffs taking effect on March 3 and interest rate decisions looming. While home sales increased from January, new listings declined, an unusual trend for the season. With a federal election and mortgage renewals on the horizon, market conditions remain unpredictable heading into spring. But after several years of below average activity, this is a market just waiting to move.

For other regions, contact Berna Yazgan

Beyond her professionalism, Berna’s warm, friendly, and reassuring approach made working with her a pleasure. She genuinely listens to her clients’ needs and goes above and beyond to help them find the right home. I would trust Berna completely and highly recommend her to anyone looking for a dedicated and reliable realtor.

Our criteria this time were a bit more challenging, but with her patience, deep knowledge, and guidance, we finally found the home that felt just right. Throughout the entire process, she wasn’t just a real estate agent. She was a true advisor and a calm, reassuring presence.

Looking back, choosing to work with her was one of the best decisions we made. We couldn’t be happier with the home we found and the experience we had.

Highly recommended to anyone looking for not just a house, but a place to truly call home. Thank you again!

She was endlessly patient with us—always ready to answer questions, walk us through the details, and offer honest advice without ever making us feel rushed or pressured. From the very beginning, it was clear she truly cared about us finding the right home, not just making a quick sale.

Berna has that rare mix of being incredibly professional and deeply personal. She made what could have been a stressful process feel manageable and even exciting. We always felt supported and in good hands every step of the way.

I’m so grateful for everything she did for us, and I can’t recommend her highly enough. If you’re buying or selling, you’ll want Berna in your corner—both as a realtor and as the genuinely kind person she is.

————