The Early Buyer Gets the Home

- Positive signs as 2025 came to a close

- Don’t wait for the rates

- Active listings down to 11,000 from the peak of 17,500

- Low sales levels show increased pent-up demand

December Market Analysis: Stability, Selective Strength, and a Foundation for 2026

December is rarely a month that defines a market. It reflects sentiment more than momentum, discipline more than urgency. This year was no different. Across Metro Vancouver, December activity cooled as expected, but beneath the seasonal slowdown lies a market that is quietly stabilizing, selectively strengthening, and positioning itself for a more active year ahead.

Sales slowed month-over-month across most regions, but that headline masks a far more important story: inventory contracted sharply, new listings fell dramatically, and sales-to-listings ratios rebounded. Total Active listings declined 29% from the peak in June. Over the last three years, total listings peaked in the fall, except for this year. A sign of some seller resistance in taking part in this market. For buyers, the time is now to take advantage of the opportunity that still exists. These are not the signs of a weakening market, moreover they are the early mechanics for returning balance after years of uncertainty.

Greater Vancouver Overview: Seasonal Level of Transactions, Healthier Structure

Total residential sales across Greater Vancouver reached 1,537 units in December, down 17% from November and well below the October peak in the fall market. Total sales in Greater Vancouver finished with 23,800 for the year, the lowest since 21,950 in 2,000. At the turn of the century, there were a lot few homes and people to buy them. A telling number that means there are a lot of people who have held off making a move and are ready to do so.

The decline in December, however, aligns almost perfectly with historical December patterns and should not be interpreted as fading demand. In fact, sales were 14% higher than December 2023, confirming that buyer participation remains meaningfully stronger than it was two years ago even though it was down 13% from a year ago.

Greater Vancouver sales in December were 18% below the 10-year average, after November was 21% below the 10-year average. This wasn’t a slow December compared to what’s typical for the month, and perhaps with milder weather in January, the market will heat up sooner rather than later.

The more telling data is the timing of sales.

The more significant number to look at is the comparison from the spring and fall markets. Typically, total sales in the first six months far exceed the last six months. In 2025, Greater Vancouver sales were only 2% higher in the first six months, compared to 2024 with 10% in the first six months, 2023 with 24% in the first six months and 2022 with 82% in the first six months (although attributed to the sudden rise in interest rates at the end of the first half of the year). The only year like this was 2019 with has 25% fewer sales in the first six months. After 2 down years, a recovery began in late 2019 only to be interrupted by the pandemic. This could point to improving market conditions.

The supply side tells its own compelling story.

Active listings ended the month at 12,550, down a significant 17% from November, even though inventory remains 15% higher year-over-year. This contraction is important. It shows sellers stepping back and not just seasonally, not flooding the market, while buyers continued to transact at the same pace through the fall.

New listings tell the same story. Just 1,905 properties came to market in December which was down nearly 50% from November and more than 65% from early fall levels. While seasonal, this drop reinforces a broader theme. And opposite to the breakdown in sales over the year, 37% of new listings occurred in the first six months, compared to 22% in 2024 and 13% in 2023. Sellers held back as the year progressed, which contributed to the decline in active listings. Buyer choice decreased, which will slow the decline of prices.

The number of new listings in November were 11% above the 10-year average after November was 3% above, October at 16%, and September at 20%. November and December showed a decline in Seller activity in the market, which resulted in the steep decline of new listings. Savy buyers will take advantage before more buyer competition in the market and less choice.

By numbers the region remained at 8 months’ supply, with December typically seeing a rise in that number due to the seasonal nature of a slower market. Still on the border of a balanced to buyer’s market.

Vancouver Westside: Quiet Strength Beneath the Surface

Vancouver’s Westside followed the seasonal script, with 287 sales in December, down from November and October but still 22% higher than December 2023. Activity slowed, but it did not disappear—and that distinction matters.

Active listings fell 18% month-over-month to 2,366, leaving inventory essentially unchanged year-over-year. This is not excess supply building; it’s a market finding equilibrium.

The Westside remains selective, not stagnant. Buyers are cautious, but motivated. Sellers are patient, but realistic. That’s how stable markets behave.

Vancouver East: Stabilizing After a Reset

The East Side of Vancouver experienced a more pronounced slowdown in December sales, finishing the month at 158 transactions. While down from recent months, sales were still 7% higher than December 2023, confirming a floor under demand.

Inventory tightened meaningfully, with active listings dropping 18% from November. New listings also fell sharply yet remained well above year-ago levels, evidence of renewed seller confidence compared to last winter.

The Suburb Story

With just five months of inventory, North Vancouver sits squarely in balanced market territory. The sales-to-listings ratio surged to 110%, signaling competition on the right properties and renewed urgency among buyers. This is not a market waiting for clarity—it already has it.

Richmond posted 165 December sales, down from earlier months and well below year-ago levels. Inventory remains elevated, with 11 months of supply. This is a market transitioning from oversupply toward normalization. Momentum is slow—but direction matters more than speed.

Burnaby continues to behave as several distinct markets rather than one. Burnaby North posted a strong December, with sales up 15% month-over-month and inventory dropping significantly. Months of supply fell to 6, and the sales-to-listings ratio climbed to 90%. Burnaby South showed improving balance, with inventory declining and ratios rebounding into the low 80s. Burnaby East remains slower, but even there, inventory is contracting and year-over-year listing growth suggests confidence is returning. Overall, Burnaby’s trajectory is improving, led by transit-oriented and well-priced segments.

New Westminster is one of the most encouraging stories in December. Sales increased month-over-month and were 46% higher than December 2023. Inventory dropped sharply, months of supply declined to 6, and the sales-to-listings ratio rose to 89%.

The Tri-Cities: Clear Signs of Recovery.

Across Coquitlam, Port Moody, and Port Coquitlam, December data points to strengthening fundamentals. Coquitlam saw sales rise year-over-year, inventory fall, and months of supply improve to 7. Port Moody stood out with sales doubling year-over-year and inventory contracting sharply, settling into balanced conditions. Coquitlam remains stable, with improving ratios and steady demand.

Maple Ridge and Pitt Meadows experienced slower December volumes, but inventory tightened and ratios improved. These areas often lag during seasonal slowdowns but respond quickly when confidence returns. Ladner remains challenged with elevated supply and saw extremely low levels of sales in December, while Tsawwassen showed meaningful improvement, with sales up strongly year-over-year and months of supply declining.

Fraser Valley Listings sees Massive Drop to Finish 2025

Much like Greater Vancouver, The Fraser Valley experienced one of the slowest years for sales in decades. With 943 sales in December, they were down 3% from November and down 8% from December 2024. Like Greater Vancouver, sales were up from December 2023 at 10% higher. The biggest surprise though came on the inventory side where the total number of active listings finished 25% lower in December compared to November, only 10% higher from the end of 2024. This tightening supply will help to stabilize the market in the Fraser Valley.

With the reduction of inventory, months of supply in the Fraser Valley dropped down to 8 months compared to 10 in November, closer to balance than we’ve seen through 2025. A positive sign to start the year, especially with Surrey showing the best improvement in December.

The Bigger Picture: December Did Its Job

December did exactly what December is supposed to do: slow the market down, clear excess, and reset expectations.

What matters is what didn’t happen: Inventory did not surge and demand did not disappear. Instead, the market quietly absorbed listings, and entered the new year with leaner supply and stronger ratios. That is not a fragile setup. It’s a constructive one

As we move into 2026, the groundwork is being laid for a more active spring, one driven not by speculation or urgency, but by confidence, affordability adjustments, and a growing acceptance that the market has already done most of its correcting.

Markets don’t need fireworks to turn. Sometimes they just need December to be December.

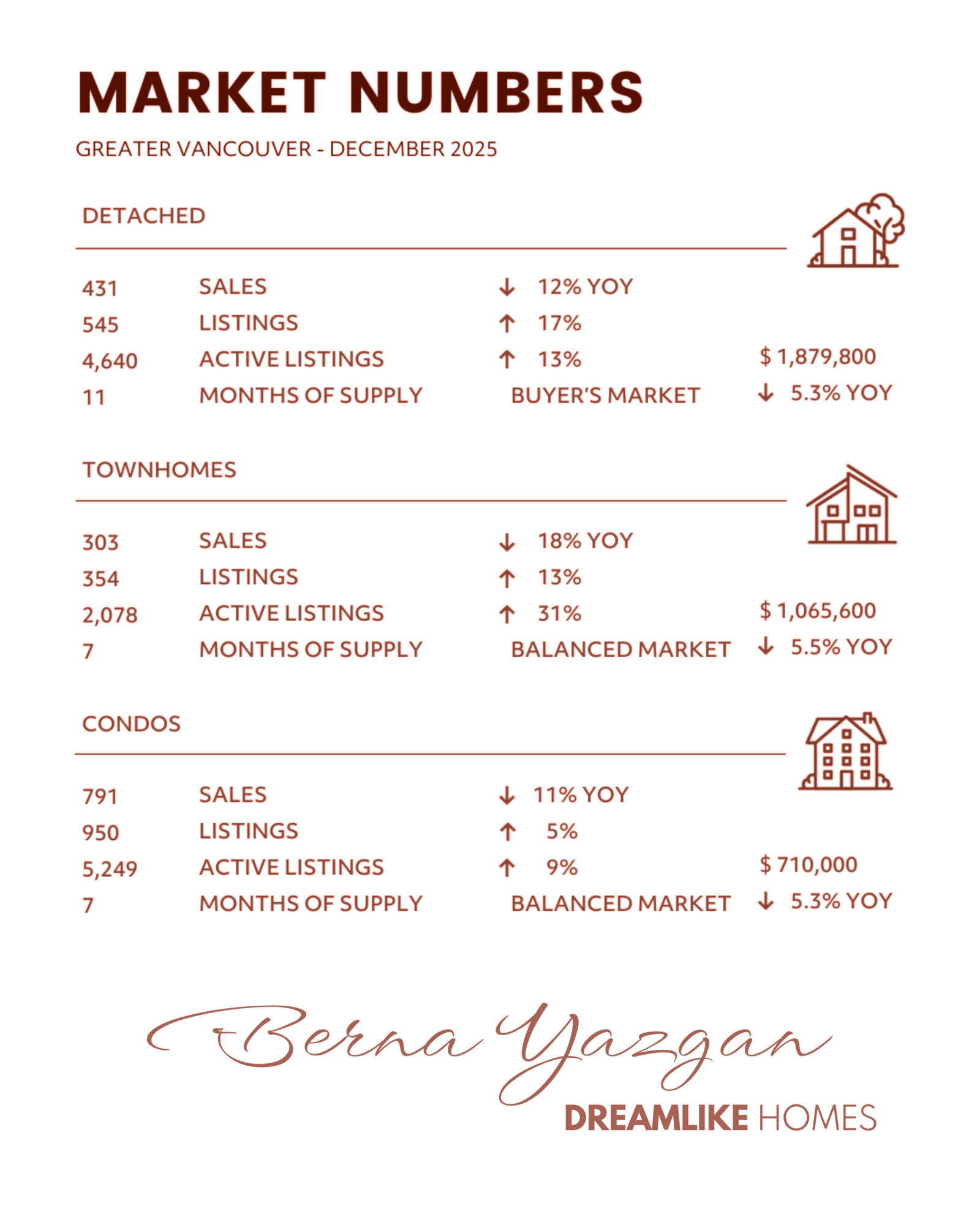

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in December were 1,537, down from 1,846 (17%) in November, down from 2,255 (32%) in October, down from 1,875 (18%) in September, down from 1,765 (13%) in December 2024, and up from 1,345 (14%) in December 2023; Active Listings were at 12,550 at month end compared to 10,948 at that time last year (up 15%) and 15,149 at the end of November (down 17%); the 1,905 New Listings in December were down 49% compared to November, down 65% compared to October, down 71% compared to September, up 10% compared to December 2024, and up 41% compared to December 2023.

Month’s supply of total residential listings is steady at 8 month’s (buyer’s market conditions) and sales to listings ratio of 81% compared to 49% in November, 102% in December 2024, and 99% in December 2023.

Beyond her professionalism, Berna’s warm, friendly, and reassuring approach made working with her a pleasure. She genuinely listens to her clients’ needs and goes above and beyond to help them find the right home. I would trust Berna completely and highly recommend her to anyone looking for a dedicated and reliable realtor.

Our criteria this time were a bit more challenging, but with her patience, deep knowledge, and guidance, we finally found the home that felt just right. Throughout the entire process, she wasn’t just a real estate agent. She was a true advisor and a calm, reassuring presence.

Looking back, choosing to work with her was one of the best decisions we made. We couldn’t be happier with the home we found and the experience we had.

Highly recommended to anyone looking for not just a house, but a place to truly call home. Thank you again!

She was endlessly patient with us—always ready to answer questions, walk us through the details, and offer honest advice without ever making us feel rushed or pressured. From the very beginning, it was clear she truly cared about us finding the right home, not just making a quick sale.

Berna has that rare mix of being incredibly professional and deeply personal. She made what could have been a stressful process feel manageable and even exciting. We always felt supported and in good hands every step of the way.

I’m so grateful for everything she did for us, and I can’t recommend her highly enough. If you’re buying or selling, you’ll want Berna in your corner—both as a realtor and as the genuinely kind person she is.

————